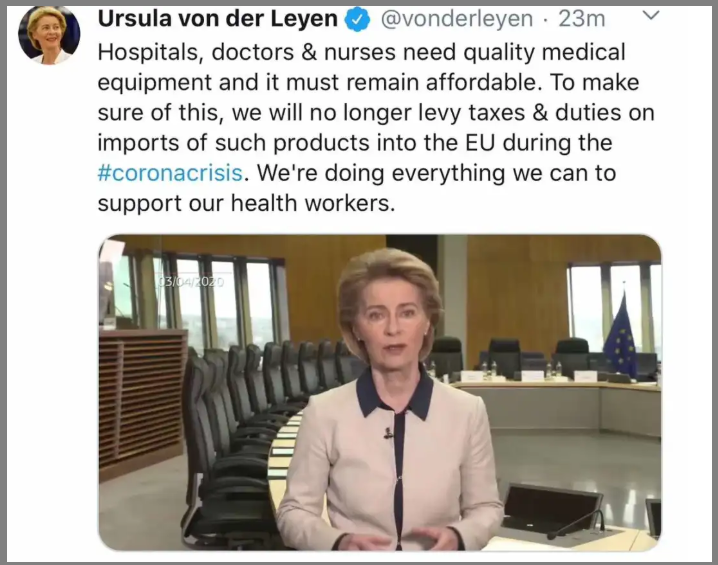

On 20 March 2020, the European commission invited all member states, as well as the United Kingdom, to request exemption from tariffs and VAT on imports of protective goods and other medical equipment from third countries.After consultations, European commission President Ursula von der Leyen formally decided on April 3 to temporarily exempt medical equipment and protective equipment imported from third countries (i.e., non-eu countries) from tariffs and value-added tax to help fight novel coronavirus.

The supplies granted temporary exemption include masks, kits and respirators, and the temporary exemption is for a period of six months, after which it is possible to decide whether to extend the period depending on the actual situation.

Taking the import of masks from China as an example, the eu has to levy a 6.3% tariff and a 22% value-added tax, and the average value-added tax of respirators is 20%, which greatly reduces the import price pressure of purchasers after exemption.

Post time: Apr-09-2020